The Official Tech4states Blogs

The online payment method was limited back in time, but now there are so many payment methods available online. The top trendy payment method these days is to buy now and pay later. Customers now pay according to their card availability and budget as well with Visa or Mastercard. Some customers prefer to pay with a digital wallet, Apple pay, or Paypal.

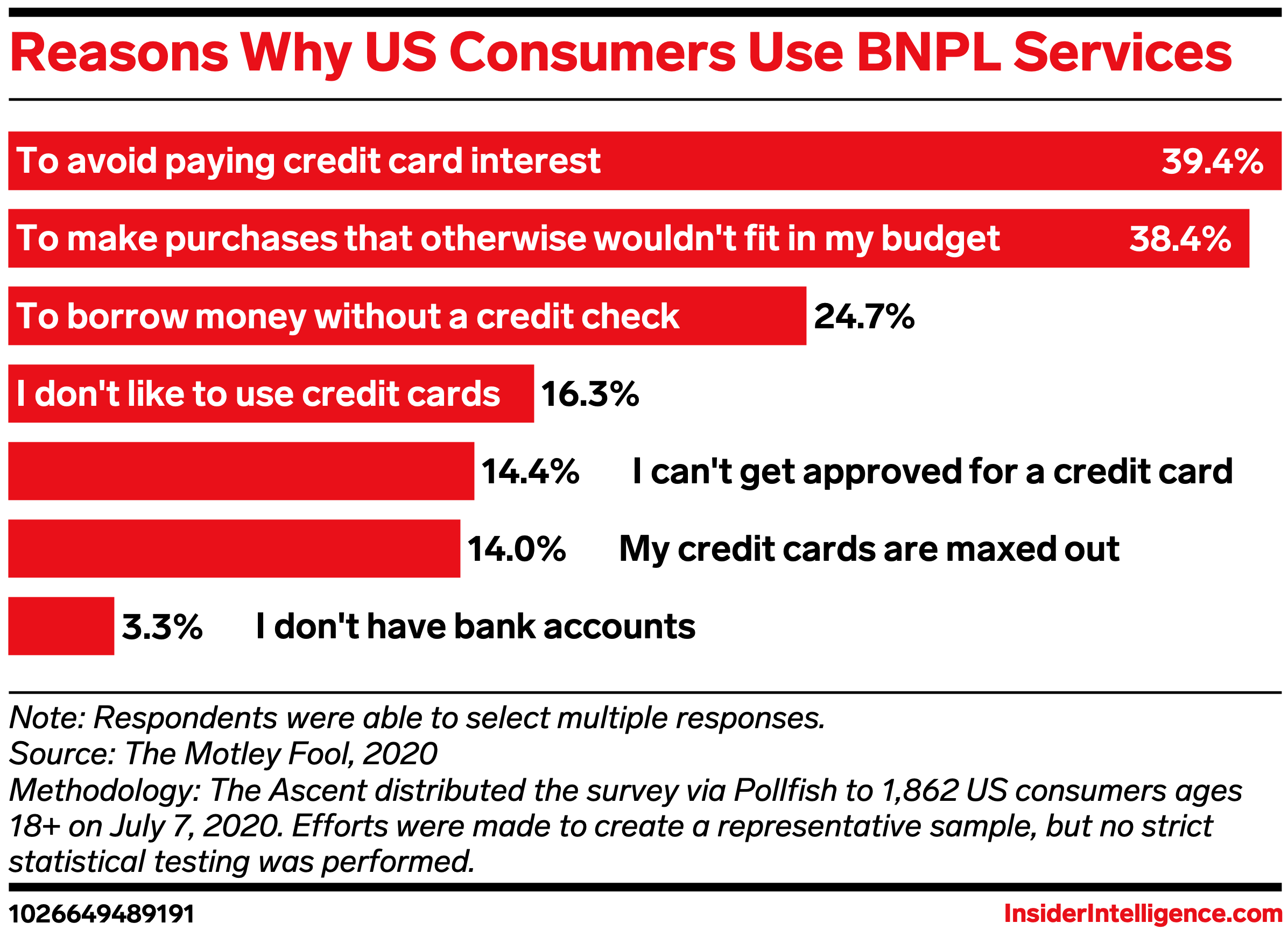

According to insider intelligence, 39.4% of US customers use BNPL service to get away from credit card interest, 38.4% use it to make purchases to fit in their budget, 24.7% to avoid credit checks and borrow money, and other 16.3% use BNPL because they don’t like to use credit cards.

But what exactly is a payment solution, and how does the buy now pay later method help to grow your business?

What is Buy Now Pay Later?

You can easily guess the meaning of this by its name “buy now, pay later.” This payment solution has provided ease to the customers and let them get the product with half-payments, or they can pay in installments according to the dates provided by the whole seller or service provider.

This way of payment is a cooperative and user-friendly alternative in contrast to the old school method that requires installment first and product later. But in online shopping, buy now, pay later; the product is automatically delivered to your doorstep when you purchase with your first installment.

Working Procedure of Buy Now Pay Later Option

Buy now pay later; the whole company’s working criteria is that at every checkout, the customer might typically get the product sometime after the first transaction, usually in 30 days. The customer can pay in full or maybe in smaller installments with time.

On average, the installment goes up to three to four equally spaced payments debited directly from the customer’s card. Moreover, the good thing about the pay later option is that there are no extra fees or interest charges if the customers pay the installments timely.

Aside from that, the participating merchants also pay the provider around 2% – 6% commission along with a fixed fee on every transaction.

Main Customers of the Buy Now Pay Later Method

Mainly the main customers of the buy now pay later online shopping method is young generations which include Generation Z (aged 21 – 25) and Millennials (26-40).

According to a survey conducted by Forbes, the number of people opting for the buy now pay later method among Gen Z and Millennials has grown by 600% since 2019 (right after the covid-19 pandemic), while the Millennials ranges have more than tripled.

The stats have shown that the future primary payment method is to buy now and pay later, especially in future generations.

Benefits of Buy Now Pay Later

The number of users has increased that use the buy now pay later option and consider it as an ultimate solution for businesses. It is now the business’s responsibility to understand why consumers are more likely to opt for BNPL and how they can take the most benefit out of it.

Flexible and Convenient

For consumers that don’t carry cash and are fond of using the credit cards option. Buy now pay later offers the most convenient and flexible option.

Affordable Way to Finance Purchases

This payment method is affordable to get something you want urgently with less money and then pay them in installments.

It will work instantly if you are at a store, the payment approvals are quick. In addition, if you want to order an item for another date. Buy now, pay later options have taken care of it and allow you to pay upfront and ensure timely delivery without any payment issues and is responsibly delivered.

Check the list of the easiest payment getaways in the USA for a convenient payment mode.

How Does it Benefit Retailers?

Retailers want to get paid instantly even if consumers have taken the pay-in-installments option. The main buy now pays later suppliers like Sezzle, Klarna, and Affirm and immediately transfers the full payment to the retailer on any purchase done by the customer.

The smart use of the algorithm is set to analyze the credit risk for both the consumer and retailer; the supplier has to pay the full amount to the retailer even if the consumer is a defaulter.

Here are the interesting benefits taken by retailers by implementing a buy now pay later option:

Rise in Sales

It feels like a burden to spend a big amount of money in one go leaving your bank account empty, or when you have to pay high-interest rates on your credit card. It is challenging to purchase a big item. Here is when buy now pay later made a positive impact on the conversion rates.

Pay-in-installment options have increased sales because they reduce the stress of paying high-interest rates or money instantly, encouraging people to shop more easily and complete their purchases in installments.

Fascinate New Customers

People like to try fabric or shoes to have a sense of comfort before buying them officially. But now things have changed. Online shopping is preferred compared to physical shopping since the covid-19 outbreak. This option has left customers with no option but to keep the product they have purchased, whether they like it or not or if it fits them.

Buy now pay later has made things easier. You can now shop online and have the free product returns offer or dedicated support staff. Those companies who have a buy now pay later payment method can minimize this barrier for consumers giving them more flexibility in online shopping.

Around 66% of consumers purchase a product after seeing the return policies in which half of the consumers will leave the store if they see strict return policies, as reported by a UPS study.

A business with an easier return policy for customers considers it a chance to improve its relationship with customers.

Smooth Customer Experience

You can also add reward programs or loyalty schemes to create a long-term and better customer experience, especially for your target market, which includes young generations that will ultimately generate revenue.

Achieve High Customer Lifetime Value (LTV)

Buy now pay now (BNPL) allows customers to purchase according to their budget. This method benefits younger generations because they look for items they can pay for in installments as they are mostly running low on money.

Implementing BNPL has a positive impact on businesses and increases customer retention. This method lets customers return and shop for every big ticket item.

Wrap Up

Buy now pay later is an effective way to buy big items with little money and then keep paying in installments according to your flexibility. This instant product delivery with this method has eased customers who look for big items immediately to the organizations offering the BNPL method. Moreover, this option is beneficial for both consumers and retailers as well. You can buy anything in installments. The installment time depends on the company’s policies. You can opt for our eCommerce web development company to create a BNPL feature in your eCommerce website and to get the full feature integration and best graphics on your website.

Start Your Project

Our Expert Are Waiting to Discuss

Your Project Details.

Tech4states Helping brands to digitally transform with a spice of innovation and technical expertise.

(239) 215-2006

(239) 215-2006